No Record Found

Latest News

Samsung aims for Rs 10,000 cr revenue from its AI TV...

Daimler India Commercial Vehicles to enter into batt...

PM Narendra Modi holds roadshow in Assam`s Guwahati ...

Gujarat CM Bhupendra Patel attends public meeting in...

India will continue to be the driver of global growt...

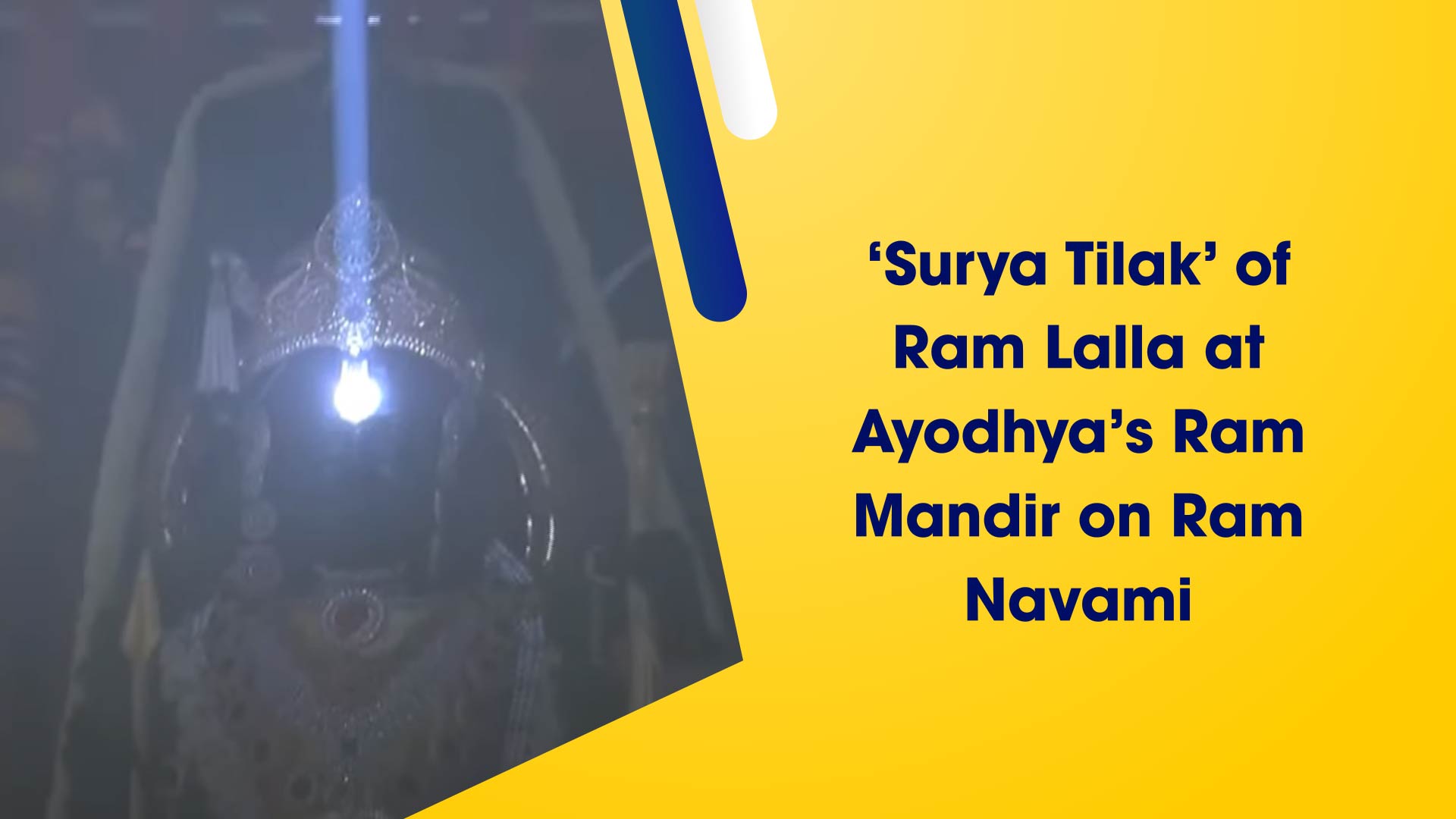

`Surya Tilak` of Ram Lalla at Ayodhya`s Ram Mandir o...

UP CM Yogi Adityanath performs havan at Gorakhnath T...

Ace shuttler PV Sindhu along with family members vis...

Perspective on US Fed by Ms. Madhavi Arora, Lead Eco...

Klub teams up with U GRO Capital to aid INR 150 cror...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found