No Record Found

Latest News

The markets are expected to open marginally lower to...

Evening Roundup : A Daily Report on Bullion Energy &...

`Just married` Arti Singh offers a peek into her 'pe...

India's Kajaria Ceramics posts surprise Q4 profit dr...

Government launches Meditech Stackathon to give big ...

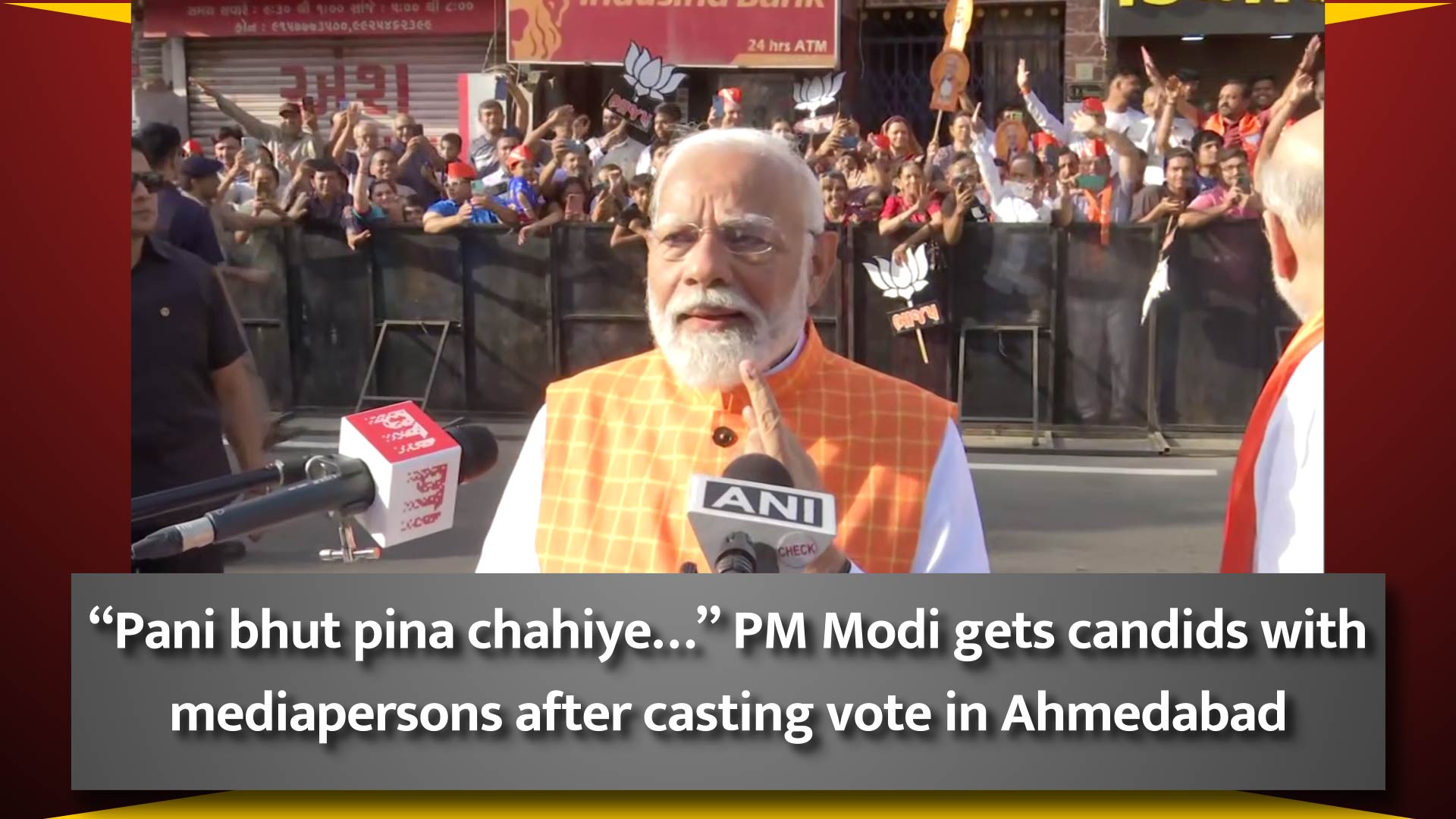

`Pani bhut pina chahiye ` PM Modi gets candid with m...

Centre to hold meeting with states to formulate Mini...

Deshmukh family casts vote in Maharashtra?s Latur

ICMAI launches Cost and Management Accounting Super ...

Adani Group chairman Gautam Adani casts his vote | L...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found