No Record Found

Latest News

Crude oil prices jumped after US officials said Isra...

Buy HDFC Life Insurance Company Ltd For Target Rs 72...

Buy Infosys Ltd For Target Rs 1,738 - Religare Broki...

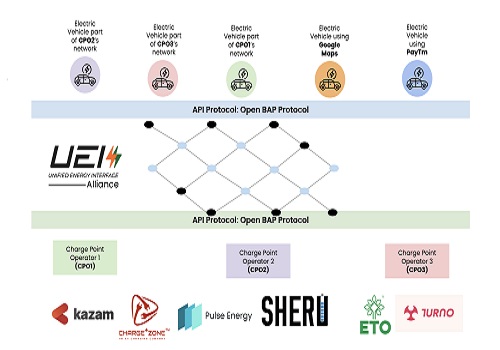

20 energy firms create alliance for EV charging via ...

Stock of the day : ITC Ltd For Target Rs.12 - Religa...

Remsons Industries trades higher on the BSE

Agri Commodity Technical Report 19 April 2024 - Geoj...

MCX Crude oil is likely to rise back towards 7250 le...

Commodity Intraday Technical Outlook 19 April 2024 -...

Agilitas Sports acquires exclusive rights for Lotto ...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found