Technical Forecast : Nifty extends gains; bias remains optimistic by Prabhudas Lilladher Ltd

Market Preview

Nifty extends gains; bias remains optimistic

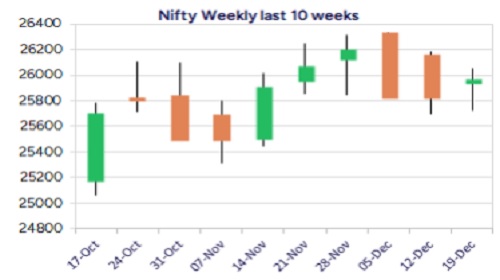

Nifty gained further, closing above the 25,950 zone, with the broader markets also showing active participation to support the benchmark index, and can anticipate further rise in the coming days. Bank Nifty witnessed a decent positive move to close above the 59000 zone, with bias getting better, anticipating further upward move in the coming days. The market breadth was strong with the advance-decline indicating a ratio of 2:1 at close.

Market Forecast

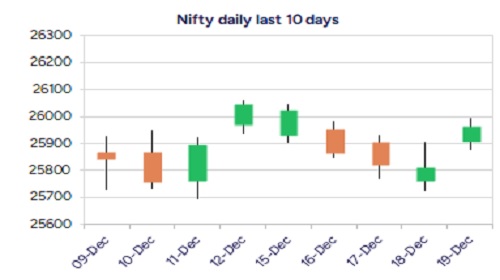

Nifty daily range 25800-26100

Nifty continues to gain strength, sustaining above the important 50EMA level, which is positioned near the 25750 zone, maintained as the strong near-term support, and currently closing near the 25960 level has further improved bias and sentiment overall. With the broader markets supporting the benchmark index, on the upside, Nifty needs to breach above the important hurdle of the 26050-26200 zone, which shall establish further stability and conviction for further upward movement in the coming days.

Bank Nifty witnessed a range-bound session with the 59000 zone sustained and closed in the green with a 156-point gain, indicating some hopes. The index has got the important 50EMA at the 58351 level, which would be the next near-term support zone, and, on the upside, a decisive breach above the 59500 level would improve the bias; thereafter, expect further rise.

The support for the day is seen at 25800 levels, while the resistance is seen at 26100 levels. BankNifty would have the daily range of 58500-59500 levels.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

Technical Forecast : Nifty marches ahead; nearing 25500 zone by Vaishali Parekh, Vice Presid...