Union Budget FY27: No magic wand - By Elara Capital

Having undertaken considerable measures to boost demand outside the Budget and being constrained by resources, the Union Budget FY27 focuses on laying the foundation for “Future India” by focusing on ‘new-age’ sectors. Overall, the Budget aims at boosting value addition and export promotion by building resilience in supply chains. Elevated government borrowing, combined with the modest positive impact of this budget on FY27 earnings, is expected to remain a drag on market performance.

Value addition and new-age sectors – Main essence of the Budget: The Budget shifts emphasis from basic assembly or volume growth to high-value addition via R&D, full-stack capabilities, processing, and global competitiveness in emerging ("new-age") areas of semiconductors, biopharma, critical minerals/rare earths, advanced textiles, electronics components, and more. The allocation for India Semiconductor Mission 2.0 (INR 10bn), India AI Mission (INR 10bn), EMS component manufacturing (INR 400bn from INR 229.1bn), support for rare earth corridors and long-term tax holiday for foreign cloud services providers using Indian data centres corroborates the tilt in the budget.

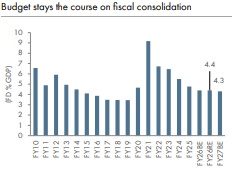

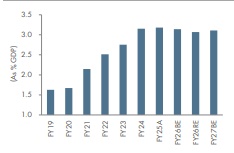

Pivot to debt-GDP ratio allows 11.5% hike in capex over FY26RE: The budget stayed the course on fiscal consolidation, whilst moving to debt-GDP ratio, thus allowing space for capex to grow by 11.5% YoY in FY27BE versus FY26RE. The debt-to-GDP ratio is estimated to be 55.6% of GDP in FY27BE from 56.1% of GDP in FY26RE. As a percentage of GDP, allocation is 3.1% – same as in last year. The resources of public enterprises are projected to grow by 11.5% too, with the total allocation of INR 4.83tn being a tad lower than INR 4.88tn of FY25A. Two major components of capex are allocation to defence (17% growth) and taxfree loans to the states ( 28.5% growth)

Realistic Budget math: The Budget math is realistic as it projects net tax revenue growth of 7.2% versus 7% in FY26RE, on nominal GDP growth estimate of 10%. Among internals, the direct tax growth is projected at 11.4%. Among indirect taxes, customs duty rationalization reflects in lower growth of 5% versus 10.8%, whereas excise duty is expected to grow by 15.6% versus 12.1% in FY26RE. The discontinuation of the GST compensation cess is impacting the overall collection under GST, which is expected to fall by 2.6% versus a growth of 1.9% in FY26RE. The non-tax revenue growth is budgeted to be flat at -0.2% versus 24.4% in FY26RE. We see some upside to this and as such, do not anticipate that government to be compelled to compress expenditure to meet deficit target.

Rising short-term borrowing; expect yields to trend towards 6.9-7%: While the government’s total dated borrowing at INR 11.7tn net is only slightly above market expectations (higher by ~INR 400 bn), a surge in short-term borrowing by INR 1.3tn versus FY26RE does not bode well for short-term rates. This amid likely higher supply from the states (Elara estimate of INR 9.5tn net for FY27BE) and rising global yields may continue to exert pressure on domestic yields. We see India 10-year yield gradually trending towards 6.9-7%, thus adversely impacting cost of funds for NBFCs and mid-sized banks that depend on wholesale funding sources. In the near term, we thus prefer well capitalised large cap private banks with steady CASA ratio. RBIs’ reaction function with respect to liquidity and yields becomes crucial hereon.

Budget offers no fillip to FY27 earnings: Markets responded negatively to the Budget as it failed to provide an anchor to FY27 earnings despite focus on macro-stability and capex spending. Structural initiatives like data centers and AI, expand the mid-term growth potential but do not uplift India’s immediate relative appeal among its EM peers. Although, higher STT on F&O can reduce speculative churn and attract higher long-term investments, today’s budget is unlikely to calm the FPI exodus as FPIs look for signs of earnings recovery and a respite in Rupee weakness before investing. MSCI India is trading at 21.3x on oneyear blended forward multiples. (60% premium to MSCI EM vs one year peak of 65%).

Please refer disclaimer at Report

SEBI Registration number is INH000000933.