India’s E-Bus Market Builds Momentum; Adoption Expected to Reach ~13% by FY28: CareEdge Ratings

According to CareEdge Ratings, India’s bus sector is witnessing a steady shift toward electric mobility, supported by policy incentives, improving infrastructure, and innovative contracting models. Electric buses are still at an early adoption stage but are gaining momentum under initiatives such as the PM e-Bus Sewa programme and large-scale aggregation by Convergence Energy Services Limited.

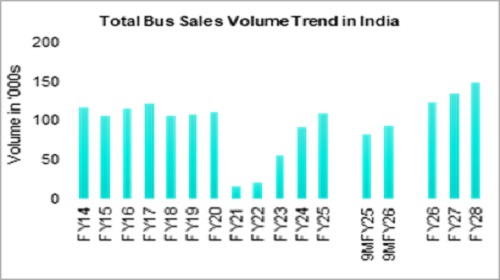

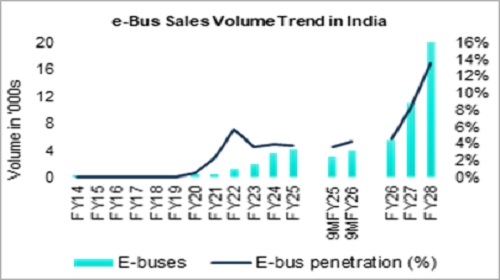

Electric buses (E-buses) accounted for ~4% of India’s annual bus registrations in FY25 and 9MFY26 with 4,237 and 3,903 e-bus registrations, respectively. The segment grew ~16% in FY25 and ~31% YoY in 9MFY26 (on a low base), supported by central government incentives, enabling infrastructure, and the evolving Gross Cost Contract (GCC) framework. The broader bus industry is on track to surpass pre-COVID volumes by the end of FY26.

Previously, e-bus penetration was expected to reach ~15% by FY27[1] factoring in timely deliveries from existing order books, however, delays by State Transport Undertakings (STUs) in allocating depots or ensuring adequate charging infrastructure led to deliveries falling behind schedule. Consequently, e-bus penetration is now forecasted to reach ~13% by FY28.

India has ~8 e?buses per million people vs a global average of ~94 per million. Currently, adoption has been largely concentrated in metro cities of some States (viz., Delhi ~4,244, Maharashtra ~4,038, Karnataka ~2,309 registrations as of February 04, 2026). Still, the PM e-Bus Sewa scheme is expected to expand its deployment to Tier II/III cities, driving significant growth over the medium term.

Market leadership is now shifting towards Olectra, JBM, PMI, and Switch Mobility (together accounting for ~47% and ~76% market share in FY25 and 9MFY26, respectively). The installed domestic manufacturing capacity of these 4 OEMs stands at ~32,000 e-buses per annum, with an aggregate order book of ~31,000 e-buses, largely under STU/GCC contracts. A 12–24-month execution timeline offers near-term visibility.

STUs’ shift from outright purchase to GCC (OPEX) with private operators procuring, operating, and maintaining buses on a per?km fee basis is expected to catalyse e-bus penetration. Standardised service level agreements (SLAs), tariff/wage indexation, termination and lender protections, Payment Security Mechanisms (PSMs), escrowed/ring-fenced cash flows, performance guarantees, and Debt Service Reserve Accounts (DSRA) enhance bankability. However, establishing a track record of timeliness of payment by STUs will remain a key monitorable. Total Cost of Ownership (TCO) for AC e-buses is ~15–20%, lower than that of AC diesel buses over 12 years, reinforcing their long-term attractiveness.

The government’s push for green mobility is gaining significant momentum through key initiatives like PM e-Bus Sewa and PM e-Drive. This is supported by a robust order book, highlighted by the recent finalisation of the procurement of 10,900 e-buses through Convergence Energy Services Limited (CESL).

That said, the additional deployment of 4,000 e-buses announced in the Union Budget 2026-27, along with the opening of a fresh CESL tender for 6,230 e-buses, are expected to augur well for e-bus adoption. Furthermore, falling battery/vehicle costs and expanding charging/depot infrastructure will aid sales of e-buses. Annual e-bus sales are expected to inch up gradually from a penetration level of ~4% in FY25 to reach 5,550 units in FY26 (5% penetration), 11,100 units in FY27 (8%) and ~20,000 units by FY28 (~13% of total bus sales). A higher growth rate is envisaged in FY27 and FY28 due to scheduled deliveries from the existing orderbook, which also includes the recently concluded CESL order for 10,900 e-buses. Execution will hinge on timely PSM disbursements, reliable grid and depot/charging readiness, and on schedule deliveries aligned with contracted milestones.

Currently, e-bus penetration in India remains low, but there has been a steady momentum over the past three years, reflecting greater policy thrust, cost economics, and execution depth. While early adoption was concentrated in a few large cities, deployments are now expanding into Tier II and Tier III markets. Government support through incentives, enabling charging infrastructure, and favourable GCC/standardised OPEX frameworks is expected to continue, strengthening operator confidence—especially as STUs increasingly tender capacity under these models. With an expanding ecosystem, annual e-bus sales are envisaged to reach around 20,000 units in FY28, increasing penetration to around 13%,” said Arti Roy, Associate Director, CareEdge Ratings.

Gradual Transition to Cleaner Fuels in India’s Bus Industry

“E-bus procurement for public road transport is shifting decisively towards the GCC (OPEX) model, with private operators assuming technology, maintenance, and battery risks while STUs pay indexed per-kilometre charges. Improved contract terms—covering SLAs, inflation-linked wage and power escalation, termination clarity, and lender protections—along with escrowed cash flows, guarantees, and DSRA, have materially strengthened bankability and lowered financing costs. The transition is reinforced by PM e?Bus Sewa and PM e?Drive, alongside the recent Union Budget announcement for ~4,000 additional e?buses and continued support for charging and depot infrastructure. With domestic manufacturing capacity of the leading 4 players ~32,000+ e-buses annually and an order book of ~31,000 units, it provides 12–24 months of execution visibility, supporting higher penetration. Sustained growth momentum, however, hinges on timely STU disbursements, depot/charging infrastructure readiness, and disciplined contract execution,” said Hardik Shah, Director, CareEdge Ratings.

With structural cost advantages, maturing procurement and risk?sharing, India’s e-bus market is poised for accelerated adoption through FY28 and beyond. The pace and durability of this growth will hinge on: (i) timely disbursements and strict enforcement of PSMs; (ii) reliable grid supply and adequately developed depot/charging infrastructure; and (iii) disciplined, on-schedule deliveries in line with contracted milestones.

As India advances its transition toward cleaner public transport, the electric bus ecosystem is expected to strengthen steadily, supported by government initiatives such as PM e-Bus Sewa and procurement programmes led by Convergence Energy Services Limited. Overall, sustained policy support, falling technology costs, and expanding deployment beyond metro cities are expected to keep India’s electric bus adoption on a firm growth trajectory in the coming years.

Hoping you could consider it.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Market Wrap : Markets ended slightly lower on the weekly expiry day, largely weighe...