India Strategy : Interim review – 3Q on track; Commodities shine by Motilal Oswal Financial Services Ltd

Nifty sees marginal EPS downgrades | Indo-US reset adds a structural tailwind

* In this report, we present our interim review of the 3QFY26 earnings season.

* As of 2 nd Feb’26, 199/31 companies within the MOFSL Universe/Nifty have announced their 3QFY26 results. These companies constituted i) 64% and 66% of the estimated PAT for the MOFSL and Nifty Universe, respectively; ii) 47% of India's market capitalization; and iii) 72% weightage in the Nifty.

* The earnings of the aforesaid 199 MOFSL Universe companies grew 14% YoY (in line with our estimate of 13% YoY) in 3QFY26. Overall earnings growth was driven by Metals, which grew 59% YoY; Oil & Gas rose 15% YoY; BFSI grew 8% YoY; Technology rose 12% YoY, and Automobiles increased 18% YoY. These five sectors contributed 80% of the incremental YoY accretion in earnings so far.

* Barring global commodities (i.e., Metals and O&G), the MOFSL Universe posted a 10% YoY earnings growth (in-line with our estimate of 10%). In contrast, exFinancials, MOFSL Universe earnings grew 17% YoY (vs. an est. of +18% YoY).

* Earnings of the 31 Nifty companies that have declared results so far have grown 7% YoY (vs. our est. of +8% YoY), driven by HDFC Bank, TCS, Infosys, L&T, and Maruti. These five companies contributed 65% to the incremental YoY accretion in earnings. Conversely, Cipla, ICICI Bank, and Interglobe Aviation dragged Nifty earnings lower. Six companies within the Nifty reported lower-than-expected profits, while seven recorded a beat, and eighteen registered in-line results.

* Large-caps and small-caps deliver in-line results, while mid-cap performance misses our estimates: Within our MOFSL Universe, large-caps (50 companies) posted an earnings growth of 13% YoY – similar to the overall universe. Mid-caps (63 companies) have shown weakness and delivered earnings growth of 14% YoY (vs. our est. of 22%). Multiple mid-cap sectors, such as Private Banks, Metals, Logistics, and Automobiles, dragged down overall performance. Conversely, sectors that clocked impressive earnings growth were Oil & Gas, Lending and NonLending NBFCs, Utilities, Healthcare, and Technology. These sectors contributed ~87% of the incremental YoY accretion in earnings. In contrast, small-caps (86 companies) delivered in-line performance, with earnings rising 24% YoY (our est. of +30%). Within small-caps, 64% of the coverage universe exceeded/met our estimates. Conversely, within the large-cap/mid-cap universes, 76%/68% of the companies exceeded/met our estimates.

* The upgrade-to-downgrade ratio at 0.7x: Until now, 40/55 companies within the MOFSL Coverage Universe have reported an upgrade/downgrade of more than 3% each, leading to an adverse upgrade-to-downgrade ratio for FY27E. The EBITDA margin of the MOFSL Universe (ex-Financials) expanded 20bp YoY to 17.7%, owing to margin expansion in Metals, Utilities, Cements, Capital Goods, and Chemicals. However, the margin saw a contraction in the Telecom, Real Estate, and Healthcare sectors.

* Nifty EPS cut marginally for FY26E/FY27E: The Nifty EPS for FY26E was cut by 0.3% to INR1,081 (from INR1,084) due to downgrades in ICICI Bank, Interglobe Aviation, JSW Steel, Maruti Suzuki, and Cipla. The FY27E EPS was cut by 0.4% to INR1,262 (from INR1,267) – led by Maruti Suzuki, HDFC Bank, ICICI Bank, NTPC, and Reliance Industries.

* MOFSLe PAT experienced an upgrade of 0.8% for FY27: Earnings of the MOFSL Universe witnessed a rise of 0.8% for FY27, fueled by Technology, Oil & Gas, Telecom, PSU Banks, and Metals. In contrast, the MOFSL Large-cap and smallcap universe experienced a marginal downgrade of 0.1% for FY27, while the MOFSL mid-cap universe stood out with a 5.4% earnings upgrade for FY27.

Key result highlights: 3QFY26

* As of 2 nd Feb’26, 31 Nifty stocks reported a sales/EBITDA/PBT/PAT growth of 12%/8%/7%/7% YoY (vs. est. of +11%/9%/8%/8%). Of these, 7/6 companies surpassed/missed our PAT estimates, each by more than 5%. On the EBITDA front, 7/2 companies exceeded/missed our estimates during the quarter.

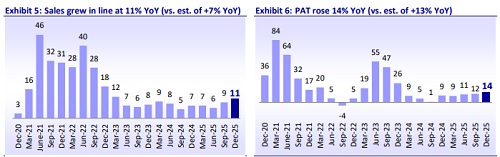

* For the 199 companies within our MOFSL Universe, sales/EBITDA/PBT/PAT were +11%/10%/10%/14% YoY (vs. est. of +7%/+11%/+12%/13%). Excluding Metals and O&G, the MOFSL Universe companies recorded a sales/EBITDA/PBT/PAT growth of 13%/9%/8%/10% YoY (vs. est. of +13%/9%/9%/10%) in 3QFY26 so far.

* Summary of the 3QFY26 performance thus far: 1) Banks: 3QFY26 has witnessed broadly stable NIMs across private banks, alongside healthy loan growth and continued improvement in asset quality, with credit costs remaining well controlled. 2) NBFCs – Lending: NBFCs delivered a mixed performance in 3Q across loan growth, with signs of demand revival visible in vehicle finance and unsecured lending; in contrast, housing financiers continued to see muted loan growth due to intense pricing competition from banks. 3) Consumer: Staple companies clocked a partial recovery in 3Q, particularly after the stability from the GST transition. Rural has been resilient, while urban demand has also started showing a positive trend. 4) Metals: During 3QFY26, ferrous companies across the board reported in-line operating performance, where EBITDA/t declined INR1000-1500/t QoQ mainly over weak NSR. Ferrous companies across the board saw healthy volume growth of 12% YoY and 6% QoQ, which partially offset the muted NSR. 5) Oil & Gas: The results indicate mixed performance so far. OMCs continued to post stable results, whereas weakness persisted in the gas space. Reliance Industries posted a soft 3Q, hurt by a weaker performance of Reliance Retail (RRVL). 6) Technology: The IT services companies (within the MOFSL Universe), despite seasonally weak conditions in 3QFY26, reported betterthan-anticipated earnings; the sector witnessed a median revenue growth of 1.7% QoQ CC (+1.5%/-1.1%/-0.6%/+1.7% in 2QFY26/1QFY26/ 4QFY25/3QFY25).

* View: In a swift reversal of events, the long-awaited Indo-US trade deal has been announced. This is a high-impact development and will have a multi-layered effect on the economy, prevailing market sentiments, and several sectors exporting to the US, which will benefit from improved competitiveness. The Indo-US trade announcement comes on top of the Indo-EU FTA, which was inked last week, and together they will help assuage the growing concerns over India’s geopolitical seclusion. Further, the Union Budget was broadly in line with our modest expectations but shorn of high-impact immediate measures, signaling more continuity in the fiscal approach of the past five years. The earnings for 3Q to date have been in line. We expect ~12% earnings growth for Nifty over FY25-27E. Valuations for Nifty at ~20x remain marginally below its LPA at 20.9x 12m forward earnings, while they remain stretched for broader markets. We are OW on Auto, Diversified Financials, Technology, Discretionary, and EMS, which are our key preferred investment themes. We remain Neutral on PSBs, Healthcare, Cap Goods, Infra, and Cement, while maintaining our UW stance on Pvt. Banks, Staples, O&G, Utilities, and Metals in our model portfolio.

* Top five Nifty-50 ideas: SBI, Titan, M&M, Infosys, and Eternal; Top five Non-Nifty50 ideas: Dixon Tech, Indian Hotels, Groww, TVS Motor, and Radico Khaitan.

In-line performance, anchored by Metals

* Aggregate performance of the MOFSL Universe: sales/EBITDA/PBT/PAT were +11%/10%/10%/14% YoY (vs. est. of +7%/+11%/+12%/13%). Excluding Metals and O&G, the MOFSL Universe companies recorded a sales/EBITDA/PBT/PAT growth of 13%/9%/8%/10% YoY (vs. est. of +13%/9%/9%/10%) in 3QFY26 so far.

* Nifty-50 companies that surpassed/missed our estimates: TCS, Axis Bank, Ultratech Cement, Bharat Electronics, Dr. Reddy’s Labs, Eternal, and SBI Life Insurance exceeded our profit estimates. Conversely, ICICI Bank, NTPC, Interglobe Aviation, Tech Mahindra, JSW Steel, and Cipla missed our profit estimates for 3QFY26.

* Top FY27E upgrades: Dr. Reddy’s Labs (5.6%), Ultratech Cement (4.9%), Titan Company (4.6%), Nestle (3%), and Tech Mahindra (2.2%).

* Top FY27E downgrades: Eternal (-14.3%), Cipla (-13.2%), Maruti Suzuki (-7.5%), Tata Consumer (-4.2%), and NTPC (-3.5%).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Stocks in News & Key Economic Updates 01st Aug 2025 by GEPL Capital