Stocks in News & Key Economic Updates 12th Aug 2025 by GEPL Capital

Stocks in News

* ADANI ENTERPRISES: The company’s subsidiary will acquire full ownership of Indamer Technics, while Adani Defence & Aerospace has tied up with Prime Aero to grow its aviation MRO presence.

* INFOSYS: The company has deployed the nCino platform for ABN AMRO to streamline and modernize its lending process.

* JAYKAY ENTERPRISES: The company’s subsidiary has secured letters of intent worth ?95 crore from BrahMos Aerospace and ?15.9 crore from Bharat Dynamics.

* INSECTICIDES INDIA: The company has partnered with Corteva Agriscience to launch the insecticide ‘SPARCLE’.

* INTELLECT DESIGN: The company has launched Purple Fabric in the US, touted as the world’s first open business impact AI platform.

* INDIAN OVERSEAS BANK: The bank has cut its MCLR by 10 bps across all tenures and lowered its base rate by 20 bps to 9.8%, effective Aug. 15.

* CEIGALL INDIA: The company emerged as the lowest bidder for a ?225 crore Bulk Drug Park development project.

* PFIZER: The company has introduced its 20-valent pneumococcal conjugate vaccine (PCV20) for adults in India.

* INDIAN HOTELS: The company will acquire 51% stakes in ANK Hotels for ?110 crore and in Pride Hospitality for ?94 crore.

* TILAKNAGAR INDUSTRIES: The company will expand Prag Distillery’s capacity from 6 lakh to 36 lakh cases annually with a ?25 crore capex.

Economic News

* Lok Sabha Passes Simplified Income Tax Bill to Replace 1961 Act from 2026: The Income Tax (No. 2) Bill, set to replace the complex 1961 Act from April 1, 2026, cleared the Lok Sabha without debate amid opposition protests. Built on the “SIMPLE” principles, Streamlined, Integrated, Minimised litigation, Practical, Learn and adapt, Efficient, it simplifies tax law by nearly 50%, clarifies deductions, strengthens cross-referencing, and defines key terms like ‘capital asset’ and ‘MSME’. Key reforms include relief on late tax refunds, no penalty for late TDS filing, advance ‘nil-TDS’ certificates, explicit deductions for commuted pensions, reinstated inter-corporate dividend deductions, clearer property tax rules, aligned MSME definitions, and replacing the current FY/AY system with a single ‘tax year’.

Global News

* Trump Extends US-China Tariff Truce Until November, Easing Trade Tensions: President Donald Trump has extended the US-China tariff truce for another 90 days until November 10, deferring a planned tariff hike and stabilizing trade ties. The pause, first agreed in May, saw US duties cut to 30% and China’s to 10%, alongside resumed rare earth exports. Both sides confirmed the extension, reached last month in Sweden, averting a jump in US tariffs to 54% and easing fears of a renewed trade war. The move buys time to address unresolved issues, including fentanyl-linked duties, Chinese oil imports from sanctioned nations, and US business operations in China. The extension also sets the stage for a potential Trump-Xi meeting in late October.

Technical Snapshot

Key Highlights:

NIFTY SPOT: 24585.05 (0.91%)

TRADING ZONE:

Resistance : 24700 (Pivot Level) and 24800 (Key Resistance).

Support: 24400 (Pivot Level) and 24300 (Key Support).

BROADER MARKET: UNDERPERFORMED

MIDCAP 150: 56479 (0.85%), SMALLCAP 250: 17491.7 (0.36%)

VIEW: Bearish till Below 24800 (Key Resistance).

BANKNIFTY SPOT: 55510.75 (0.92%)

TRADING ZONE:

Resistance: 55800 (Pivot Level) /56300 (Key Resistance)

Support: 55000 (Pivot Level) / 54700 (Key Support).

VIEW: Bearish till below 56300 (Key Resistance)

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.75% - 5.45% on Monday ended at 4.95%.

* The 10 year benchmark (6.33% GS 2035) closed at 6.4398% on Monday Vs 6.4121% on Friday .

Global Debt Market:

U.S. Treasury yields inched lower Monday as investors look ahead to key inflation data due this week which will offer fresh insights about the state of the U.S. economy. The 10-year Treasury yield was down over 2 basis points to 4.26%, and the 2 -year Treasury yield was less than a basis point lower at 3.75%. The 30-year Treasury bond yield shed nearly 3 basis points to 4.82%. Investors are expecting a busy week of economic data relations with key inflation prints out this week. The consumer price index, set to be released Tuesday morning, and the producer price index, out on Thursday, will be critical to shaping the Federal Reserve’s interest rate decisions at its September meeting. Economists are forecasting the July CPI to show a 0.2% increase on a monthly basis and 2.8% increase annually, per Dow Jones. Core CPI, excluding volatile food and energy prices, is expected to rise 0.3% on a monthly basis, and 3.1% yearly — up from June’s figures of 0.2% and 2.9% respectively. The PPI is expected to show a 0.2% monthly gain and 0.3% for core PPI, after both were flat in June. The inflation data comes ahead of a Fed meeting in Jackson Hole in Wyoming, from Aug. 21-23, which will likely influence the direction of the September meeting. “The most important thing is the CPI data,” Jay Woods, chief global strategist at Freedom Capital Markets said. “That will definitely dictate monetary policy.” Retail sales data for July and the preliminary Michigan consumer sentiment reading are also due later in the week.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.33% GS 2035) yield likely to move in the range of 6.4375% to 6.4450% level on Tuesday

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

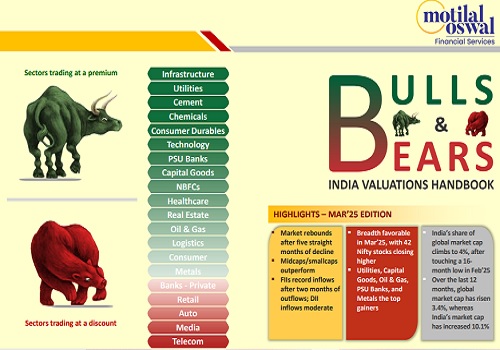

Bulls & Bears - April 2025 : India Valuations Handbook by Motilal Oswal Financial Services Ltd