Weekly Market Mirror 21st Feb 2026 by Jainam Share Consultants

MARKET REVIEW

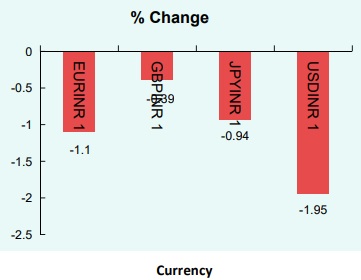

BSE Sensex closed at 82814.71 which is increased by 0.23%, Nifty closed at 25571.25 which is increased by 0.39%,Nifty Mid- Cap closed at 59513.95 which is increased by 0.13% and Nifty Small-Cap closed at 17002.15 which is decreased by -0.18%. During the week, FII net sell into cash Market Worth of Rs 217.09 Cr. and sell into F&O segment worth of Rs 18832.6 Cr. DII has net buy worth of Rs 3849.36 Cr. During the week, Crude oil closed at Rs 6057 barral (66.3 USD) which is increased at 5.84% During the week, USDINR closed at Rs 90.681 which is increased at 0.19%.

GLOBAL NEWS

Global Gold Prices Rebound Amid Volatility:This week, gold prices showed renewed strength globally after recent declines, supported by safe-haven demand and technical buying. Spot gold edged higher, stabilizing around $2,020–$2,030 per ounce, while silver also recovered modestly. Analysts noted that the rebound followed sharp mid-February losses, driven by profit- booking and stronger dollar moves. In India, 24K gold hovered near Rs 15,650 per gram, reflecting the global trend. Overall, bullion remains volatile, with investor sentiment shaped by inflation signals, energy price risks, and geopolitical uncertainties

Silver Prices Rebound Amid Global Uncertainty:This week, silver prices showed a strong recovery after recent declines, supported by global tensions and economic uncertainty. On February 21, silver surged in India and internationally, reversing the sharp drop seen earlier in mid-February when MCX futures had slipped nearly Rs4,000 per kg from January’s peak. Analysts highlight that investor demand and safe-haven buying are driving the rebound, with silver stabilizing near elevated levels after weeks of volatility. The outlook remains bullish, underpinned by structural supply deficits and resilient industrial demand worldwide.

Dollar’s Wild Ride Shakes Global Markets:This week, the US dollar saw extreme volatility, with the Dollar Index plunging to a four-year low of 95.5 on January 30 before staging a sharp rebound toward 98.0 by mid-February. The whipsaw movement has caught markets off guard, complicating trade flows and balance sheets for multinational corporations. Analysts say the rebound reflects shifting expectations around Federal Reserve policy, global growth trajectories, and geopolitical uncertainty, with the dollar entering a consolidation phase as investors reassess risks. The swings have also rippled into commodities, adding volatility to gold and silver markets worldwide

Please refer disclaimer at https://jainam.in/

SEBI Registration No.: INZ000198735, Research Analyst: INH000006448, PMS: INP000006785

More News

Nifty Open Interest Put Call ratio fell to 1.13 levels from 1.27 levels - HDFC Sescurities Ltd